- SMARTPHONE OS MARKET SHARE IN NY FULL

- SMARTPHONE OS MARKET SHARE IN NY ANDROID

- SMARTPHONE OS MARKET SHARE IN NY WINDOWS

Meanwhile almost three-quarters of both Palm’s and RIM’s shipments are in North America.

SMARTPHONE OS MARKET SHARE IN NY WINDOWS

“Shipment volumes of Motorola’s Linux smart phones in Asia, particularly China, still significantly overshadow those of its Windows Mobile ‘Q’ in North America.”Ĭanalys estimates that Linux devices represented more than 90% of the 1.5 million smart phones shipped by Motorola in Q4 2006. “The regional delineation of the top market players remains quite striking,” said Singapore-based Canalys senior analyst Rachel Lashford.

Although Palm had new smart phones on both the Windows Mobile and Garnet OS platforms in EMEA and the Asia-Pacific region, its usually strong, consumer-led Q4 was impeded by a fall of 45% in worldwide shipments of handhelds, in line with market trends. RIM retained its position as the leading smart mobile device vendor in North America, ahead of Palm for the second quarter running.

SMARTPHONE OS MARKET SHARE IN NY FULL

A full quarter’s sales of its new ‘Pearl’ smart phone, positioned as a more consumer-oriented e-mail device than its other models, helped it increase overall device shipments by 54% year-on-year.

Despite increasing pressure from competitors in the mobile e-mail space, RIM performed well this quarter. Converged device shipments (smart phones and wireless handhelds) rose 42%, while unconnected handhelds posted their largest fall yet, down 41% compared to the same period one year ago.Ĭanalys estimates that Nokia shipped 11.1 million smart phones in the quarter, with its popular Symbian S60-based Nseries devices, particularly the N73, continuing to drive the volume. Year-on-year market growth for all smart mobile devices combined shifted down to 30%, compared to the 50% seen in Q3 2006, but unit volumes still hit a new quarterly peak of 22.1 million. Its EMEA smart phone shipments were also considerably higher than in previous quarters thanks to the arrival of new models. Palm remained in fourth, while Sony Ericsson broke into fifth place for the first time since Q2 2004, thanks largely to shipments of FOMA devices in Japan. Nokia retained its lead, while RIM moved up a place into second, nudging ahead of Motorola. Highlights from the Canalys Q4 2006 global smart mobile device researchĬanalys’ latest market estimates show that Nokia, RIM, Motorola and Palm each held onto a place among the top five worldwide smart mobile device vendors in Q4 2006, but some positions changed.

SMARTPHONE OS MARKET SHARE IN NY ANDROID

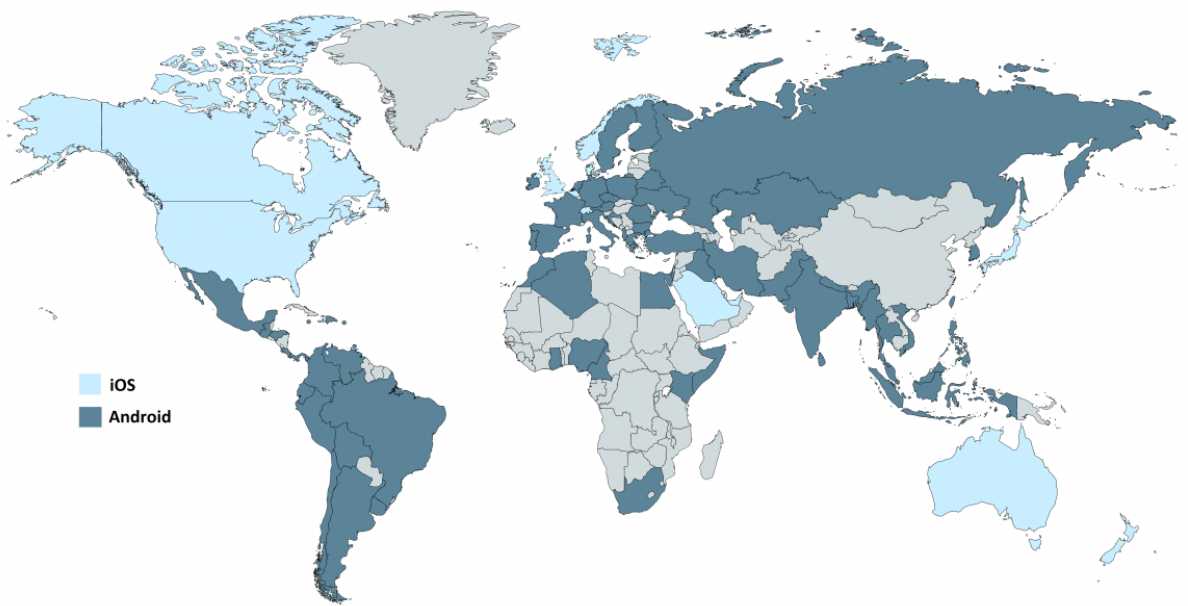

It looks like nothing is going to slow down Android at this point. Last year, its market share during the third quarter was 17.1%, but during the same quarter this year it fell slighty to 16.7% despite increased sales of the iPhone, iPod Touch and iPad. With Android installed on over a quarter of all smartphones shipped worldwide, the folks behind Symbian better hope their recent reorganization will turn things around.Īpple’s IOS, meanwhile, has remained flat. Meanwhile, Android has skyrocketed, going from 3.5% during Q3 2009 to 25.5% in Q3 2010. While Symbian still holds the lead at 36.6% of the world’s smartphone OS market, it has slipped from an overwhelming 46.6% last year during the third quarter. New data out from Gartner paint a bleak picture for Symbian and its reign of dominance in terms of smartphone OS market share worldwide.

0 kommentar(er)

0 kommentar(er)